Mining sector fund-raising drops 24 per cent

THE BOURSE WHISPERER: There is currently no shortage of junior resources exploration companies with projects that have potential to become viable economic mining operations.

There is, however, a shortage of fund providers willing to bankroll them.

According to IntierraRMG the first quarter of 2013 has been a challenging time for, not just the Australian mining industry, but for the international mining community as a whole.

The global industry has been presented with a problematic combination of rising operating costs, falling metals prices, lower ore grades and a continued scarcity in the availability of funds.

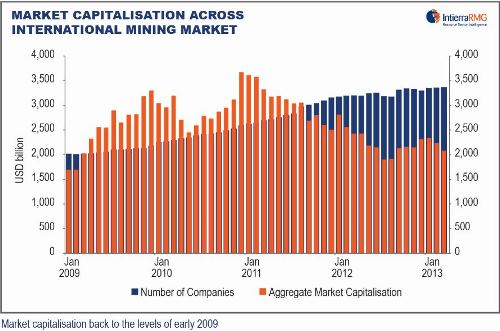

“After an 18-month decline that started at the end of 2010, the second half of last year saw a gradual recovery in the mining industry’s overall market capitalisation,” IntierraRMG said recently.

“This improvement was helped by a strengthening gold price, but precious metals, and the industry’s valuation, have gone into reverse this year.”

Source: IntierraRMG

In its latest ‘State of the Market’ report, IntierraRMG indicated the price of most metals fell considerably during the last two months of the quarter, which it said has had a particularly damaging effect on the valuations of the smaller companies.

Although 2012 ended on a fairly optimistic last quarter, IntierraRMG said this year has all the signs of being especially difficult for raising exploration finance.

“Hitherto, initial public offerings (IPOs) have played an important role in generating cash for mining projects,” the Data and Research Group said.

“However, market confidence has been dented against a backdrop of volatile markets, political turbulence and fragile economic news.”

This, according to IntierraRMG , has resulted in limited IPO activity in the past quarter for either the Toronto or London stock exchanges.

This was put down to neither retail nor professional investors having the capacity, or appetite, to fund equity raisings, and so equity markets remain constrained.

Share prices sitting at the lower end of the spectrum don’t necessarily help either with most explorers coming to grips with the stark reality that raising the necessary funds to bring themselves to the stage where they can generate cash flow from metals production is becoming increasingly difficult.

According to the IntierraRMG database of almost 3,500 listed companies, funds raised by the mining sector in the quarter to end-March dropped to under US$5.2 billion from almost US$6.8 billion in the last three months of 2012.

During this time there has also been a particularly sharp fall in the funds raised by exploration companies; dropping to only US$1.5 billion in the quarter just ended from US$3.4 billion in the December quarter.

IntierraRMG data show mining companies raised only US$0.2 billion during the quarter on the London Stock Exchange (LSE), which represents a slump of almost 80 per cent from the previous quarter.

The Toronto Stock Exchange (TSX) and Australian Securities Exchange (ASX) were not immune to the disease and also experienced sharp falls.

The good news is that there were funds made available; the bad news for the junior end of town is that almost 80 per cent of funds raised during the quarter were by companies with individual market capitalisations of over US$100 million.

If the juniors are to take anything away, it would be that IntierraLive data showed there was an improvement in the amount raised by the industry’s smallest companies – those valued at under US$10 million; however the amounts raised are still well below the funds secured in the year-ago quarter.

The worrying aspect of this statistic is that companies have typically raised most of the necessary funds for project development during the first quarter of the year.

IntierraRMG’s global data suggests that the industry is in for a bleak year.